Network 10 Audience Report 2020

2020 Audience Report. Weeks 1 to 48 2020. Consolidated 7.

Network 10 (10, 10 Peach, 10 Bold and 10 Shake) in 2020:

• The only commercial network growing its audience.

• Audience up 8% in total people in prime time.

• Audience up 8% in under 50s in prime time.

• Primary channel 10: #2 in 16 to 39s in prime time.

• Records highest shares since 2011 in key demographics.

• More of the top programs in key demographics.

• The youngest Network – four years younger than its competitors and richer in key demographics.

• Key platforms and programs are growing.

• 10 Play: Biggest ever digital audience.

Network 10 will head into 2021 as the only commercial network that has grown in 2020 boasting not only a prime time audience that is up 8% in total people and 8% in under 50s, but also its highest shares since 2011 in key demographics (under 50s, 16 to 39s, 18 to 49s and 25 to 54s).

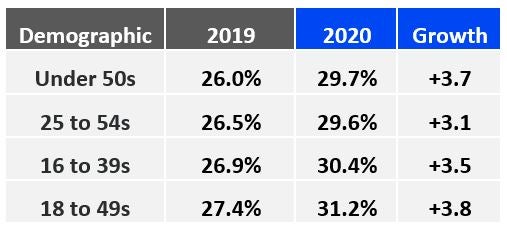

Network 10’s prime time commercial shares across weeks 1 to 48 were:

Network 10 has had year-on-year commercial share growth for 13 of the last 15 months, with 10 the only commercial primary channel to grow in 2020, up 6% across the year in total people and 6% in under 50s. 10 is also #2 in 16 to 39s.

This growth extended to the multi-channels with 10 Bold up 13%, enjoying the biggest audience increase of any commercial multi-channel. It was also up 19% in its key demographic of over 40s. While 10 Peach was up 9% year-on-year and up 25% in its key demographic of 16 to 39s.

10 Bold was the #1 commercial multi-channel in total people and 10 Peach was #2 in 16 to 39s. 10 Bold has grown for 20 of the last 21 months, and 10 Peach has grown its 16 to 39 audience for 11 of the last 12 months.

And the newest member of the family – 10 Shake – has grown its prime time audience by 6% in its key demographic of under 40s and lifted its daytime audience in under 13s by 35% from its first month. In November, it was the #1 commercial multi-channel in daytime in under 13s.

ViacomCBS’ pay TV channel audience across Nickelodeon, Nick Jr., MTV, CMT, MTV Hits, MTV Classic and Club MTV has also grown, up 7% year-on-year.

The growth of 2020 is attributed to strong performances across 10’s prime time schedule including:

• MasterChef Australia: Back To Win was up 46% and achieved its biggest audience since 2016.

• Australian Survivor: All Stars lifted 10’s audience in its timeslot by 49% compared to 2019.

• I’m A Celebrity… Get Me Out Of Here! was up 8% compared to its 2019 season, achieving its highest commercial share ever.

• The Project is currently up 20% compared to its 2019 average and is achieving its biggest audience since 2017.

• The Sunday Project is currently up 26% compared to its 2019 average and is achieving its biggest audience ever.

• 10 News First is currently up 9% compared to its 2019 average and is achieving its biggest audience since 2018.

• 10 News First 6pm is currently up 25% compared to the 2019 timeslot average.

Network 10’s digital audiences also surged this year with 10 Play having its biggest year ever, up 14% year-on-year. Its growth can be attributed to additional exclusive premium content and locally commissioned programs being added to the platform, as well as record broadcast video on-demand (BVOD) audiences for 10 shows.

So far this year, the following shows have achieved their biggest BVOD audiences ever:

• MasterChef Australia: Back To Win up 25% on 2019.

• I’m A Celebrity… Get Me Out Of Here! up 36% on 2019.

• Australian Survivor: All Stars up 5% on 2019.

• The Living Room up 33% on 2019.

• Ambulance Australia up 8% on 2019.

• The Lexus Melbourne Cup was 10 Play’s biggest ever live stream audience.

Beverley McGarvey, Chief Content Officer and Executive Vice President, ViacomCBS Australia and New Zealand, said: “Despite the obvious challenges that 2020 presented, this has been a remarkably successful year for 10 ViacomCBS.

“This year, the integration and transformation of ViacomCBS Australia and New Zealand was successfully completed. We embedded our powerful new Sales team, amplified our investment in data and technology, made television advertising even more effective, launched a new channel – 10 Shake, expanded our digital media assets and innovated user experience on 10 Play.

“Not only were we the only commercial network to grow its audience, but we also had the biggest prime time commercial shares in key demographics since 2011. Our advertising revenue share continues to grow. Our digital platforms are boasting record audiences.

“Our established suite of shows are engaging, innovative, noisy and connect emotionally with Australians like few others can.

“We cemented our position as leaders in escapist entertainment and delivered a 50-week schedule of popular content – content that is familiar, brand-friendly, celebrates and rewards talent and achievement and taps into the under 50s. As part of a global media powerhouse our commitment to making premium entertainment content, connecting across all platforms, will only continue to develop and strengthen in 2021 and beyond.”

Daniel Monaghan, Head of Programming, 10 ViacomCBS, said: “In what has been a challenging and unique year, it is great that we have strong momentum as we move into 2021 as the only commercial network to grow its audience by 8%, as well as the only commercial primary channel to grow its audience by 6%.

“We delivered the most talked about, tweeted about and meme worthy content on Australian television and it paid off with 80% of our big domestic 7.30pm franchises returning next year.

“10 had the most shows of any commercial network in the top 20 entertainment shows of the year across under 50s and all the key demos – MasterChef Australia: Back To Win, The Masked Singer Australia, Have You Been Paying Attention?, I’m A Celebrity… Get Me Out Of Here! and Australian Survivor: All Stars.

“And the standout success of the year was MasterChef Australia: Back To Win. Australians fell in love with our three new judges – Melissa, Jock and Andy – and the show captivated and united the nation at a time when audiences needed it most. It was up a massive 46%, achieving its biggest audience since 2016.

“The Project, The Sunday Project and 10 News First are all growing significantly year-on-year and continue to provide comprehensive coverage of issues that matter to all Australians.

“Have You Been Paying Attention?, Hughesy, We Have A Problem and Gogglebox continued to bring the laughs later in the evening, all three consistently topped the demos in their timeslots.

“Sport remained an important part of our 2020 schedule. Our multi-platform broadcast of The Bledisloe Cup and Tri Nations saw a 31% increase in audience, while our reimagined 2020 Melbourne Cup Carnival coverage across all our platforms reached 4.4 million Australians.

“The addition of 10 Shake to our family of channels has been fantastic. Not only does it continue to grow its prime time audience but it is currently the #1 commercial multi-channel in daytime in under 13s.

“10 Bold is the #1 commercial multi-channel of the year in total people. Not only is it up 13% year-on-year, it also achieved a phenomenal 20 months of consecutive year-on-year audience growth. And 10 Peach was up 9% year-on-year, ensuring we were the only network where all our multi-channels grew.

“Our linear success was complemented by our booming digital platforms. 10 Play and 10 Speaks have all had record years, giving audiences more ways than ever to engage with our content.

“And of course, social media channels were once again dominated by talk, tweets, images and memes of our shows.

“In 2021, we will be back with a schedule that is confident and consistent boasting another 50 weeks of programming entertainment strategy, which will all kick off with I’m A Celebrity… Get Me Out Of Here! on Sunday, 3 January.”

10’s 2020 HIGHLIGHTS: 10 Dominated The Demos.

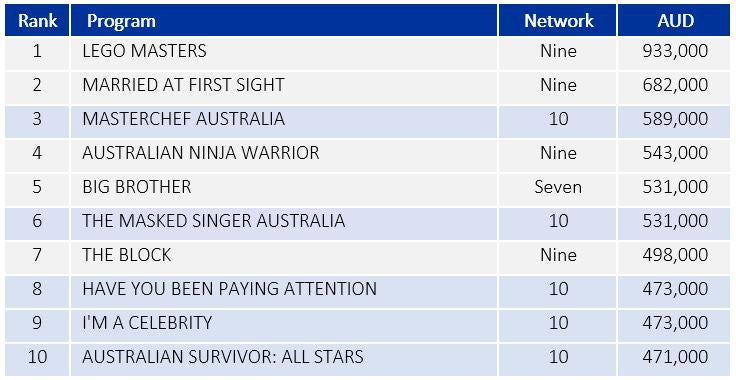

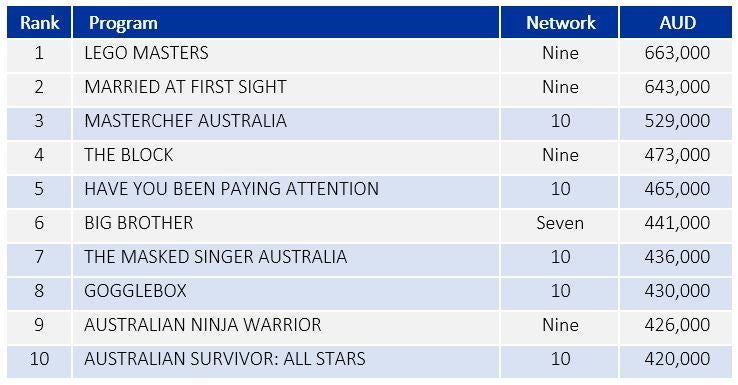

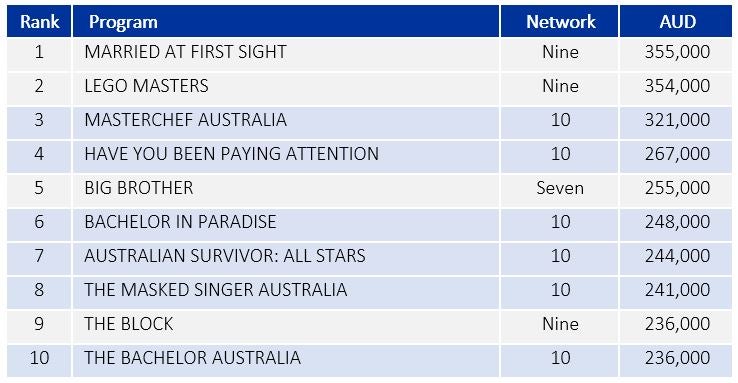

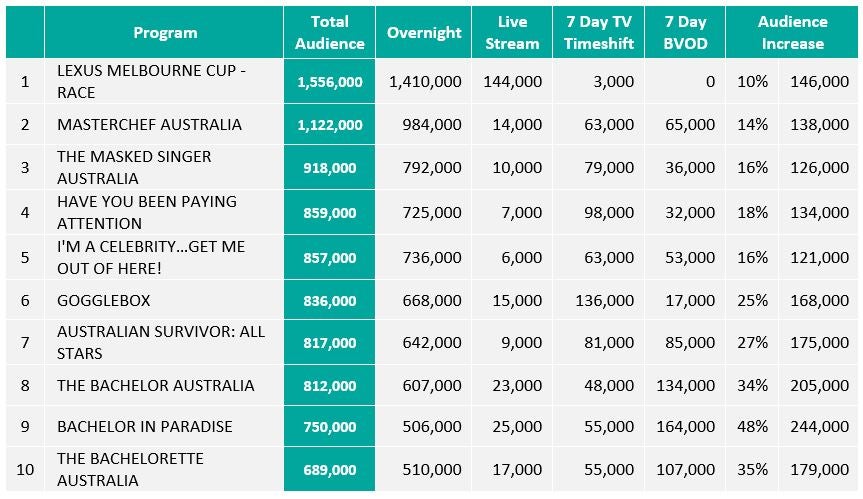

Top 10 Entertainment Shows. Weeks 1 to 48, 2020.

10 Had 5 Of The Top 10 Shows In Under 50s:

10 Had 5 Of The Top 10 Shows In 25 to 54s:

10 Had 6 Of The Top 10 Shows In 16 to 39s:

The Biggest Audiences Across Platforms For 10’s Shows:

10 Play Continues To Break Records:

• Total minutes viewed up 14% compared to the same point of 2019.

• Live streamed minutes viewed up 176% compared to the same point of 2019.

• Monthly unique visitors up 5% compared to the same point of 2019.

• 6.7 million Premium Pause events so far in 2020.

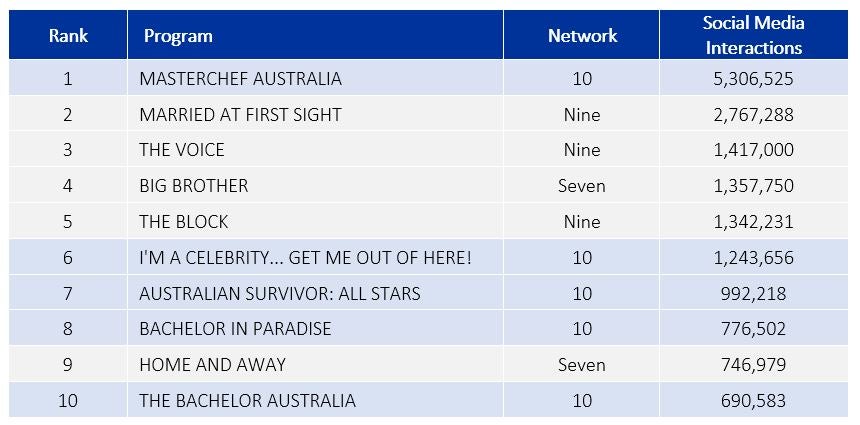

10’s Shows Get People Talking. They Are The Most Talked About, Tweeted About And Meme-Worthy Shows On Australian Television.

10 Had 5 Of The Top 10 Entertainment Shows On Social Media:

10 Speaks Turned Up The Volume:

• Six new podcasts launched in 2020.

• These were Hughesy, We Have A Problem, Jungle Nights, Starstruck with Angela Bishop, Talking Tribal with Luke Toki and James Mathison, So Now What? With Waleed Aly, and 10 News First Person.

• 1.53 million listens, up 5% on 2019.

• The Professor and The Hack: 410,000 listens, up 232% on 2019.

• So Now What? With Waleed Aly: 47,000 listens since launch in October.

Rod Prosser, Chief Sales Officer, 10 ViacomCBS, said: “In 2020, we delivered consistent, brand-safe and highly integratable environments for advertisers across all our platforms. We strengthened our commercial proposition with the addition of MTV, Nickelodeon – the #1 kids brand – and Nick Jr. to our brand portfolio, all of which have seen audience growth since March 2020.

“The success of our programming has also been reflected in our revenue. Since October 2019, Network 10 has seen 12 consecutive months of year-on-year revenue share growth.

“We supercharged the opportunities for advertisers with the launch of Effect and a whole new digital experience including a Premium Pause product on 10 Play, a non-intrusive, high impact way for brands to integrate online.

“And next year our premium offering increases with the launch of the Content Carousel, a high cut-through ad placement service on web and Connected TVs.

“This innovation positions us as unrivalled innovators and the clear leaders when it comes to BVOD integration and sponsorship amplification.

“We further accelerated addressability on mobile and Connected TVs deploying data capabilities across 85% of our ecosystem, underpinned by our premium data partners, Red Planet, Flybuys, Quantium and Smrtr. And, we are on track to have 100% addressability by early 2021.”

McGarvey added: “We would like to thank our production partners, sponsors and clients for their support this year. We are looking forward to continuing and growing these partnerships in 2021.

“We would also like to thank our amazing team across all of our brands and platforms for their incredible work, resilience and creativity.”

Source: OzTAM, 5 City Metro, 6pm to 10.30pm, Weeks 1 to 48 Consolidated 7, excluding Week 48 which is Overnight. Nielsen Social Content Ratings, Jan 1 to Nov 25 2020, Ranked on Total Interactions, commercial networks, excludes Sports, Specials and News. The Project/News lifts based on week 2 to Thursday of Week 48 2020 vs. 2019. 10 Play data source OzTAM National VPM (Week 1-48 total minutes viewed 2020 vs. 2019), Adobe Analytics. ViacomCBS Pay TV channel growth based on Weeks 1-47 2020 vs. 2019, National STV, 6am to midnight. Months of growth to October 31 2020. Program rankings based on weeks 1 to Thursday of Week 48 2020, minimum 3 episodes, excludes Sport and News. Viewer age based on Weeks 1-48, average age, 6pm to 10.30pm, network totals, 10 (49) vs. average of Nine (52) and Seven (54).